Older Adults Leverage Age for Greater Returns

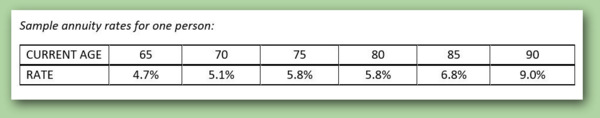

Charitable gift annuities provide donors with an immediate tax deduction, guaranteed fixed payments for life, and the satisfaction of providing future support for the Franciscans. As annuity rates are based on the age of the person establishing the annuity, older donors benefit from higher rates. Gift annuities can provide payments to one or two people, either jointly or successively.

Charitable gift annuities provide donors with an immediate tax deduction, guaranteed fixed payments for life, and the satisfaction of providing future support for the Franciscans. As annuity rates are based on the age of the person establishing the annuity, older donors benefit from higher rates. Gift annuities can provide payments to one or two people, either jointly or successively.

The minimum amount required to establish a gift annuity benefitting the Franciscan Friars of St. John the Baptist Province is $20,000. Gift annuities can be funded cash or stock. If funded with stock held for more than one year that has increased in value, donors will bypass a significant portion of the capital gains tax.

Here’s an example:

Mary Richards, age 75, establishes a $20,000 gift annuity. Based on Mary’s age, the annuity rate will be 5.8%. Mary will receive an annual annuity payment of $1,160 for life, regardless of how long she lives. $875 of Mary’s annuity payment will be tax-free until 2029. She will also receive an immediate tax deduction of $9,154. Upon Mary’s passing, whatever remains in the annuity account passes to the Province of St. John the Baptist.

For more information about gift annuities, without obligation, contact Colleen Cushard, Co-Director of Franciscan Ministry & Mission, at 513-721-4700 or ccushard@franciscan.org .

Posted in: Estate Planning, Newsletter, Prayer, Saint Francis, Support the Friars